Auto Insurance in and around Dayton

The Dayton area's top choice for car insurance

Let's hit the road, wisely

Would you like to create a personalized auto quote?

Insure For Smooth Driving

With State Farm, you can drive with confidence knowing your auto policy is reliable and dependable. With numerous savings programs including Vehicle Safety Features and Steer Clear®, State Farm aims to give you excellent savings. Not sure which savings options are applicable to you? Juan Carranco can work with you to with a personalized quote.

The Dayton area's top choice for car insurance

Let's hit the road, wisely

Coverage From Here To There And Everywhere In Between

With State Farm, get revved up for fantastic auto coverage and savings options like comprehensive coverage medical payments coverage, the good driver discount a newer vehicle safety features discount, and more!

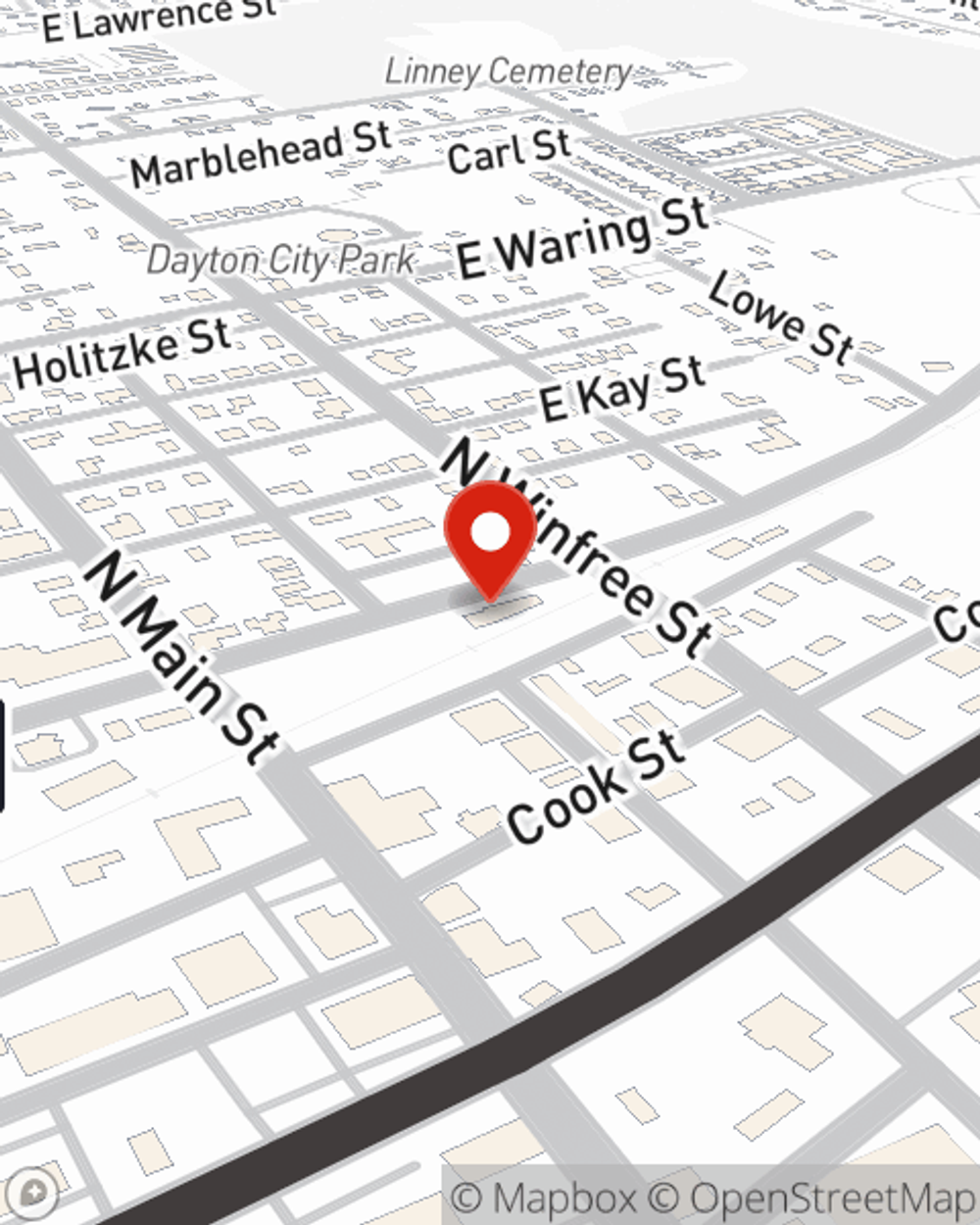

Get in touch with agent Juan Carranco's office to discover how you can benefit from State Farm's auto insurance.

Have More Questions About Auto Insurance?

Call Juan at (936) 258-8218 or visit our FAQ page.

Simple Insights®

What does boat insurance cover?

What does boat insurance cover?

Buying insurance for boats and yachts and learning the basics may help you handle the unpredictable.

Preventing backovers and rearview safety

Preventing backovers and rearview safety

Backover deaths usually happen near the home and tragically, involve children. What every driver needs to know to help prevent backover deaths.

Juan Carranco

State Farm® Insurance AgentSimple Insights®

What does boat insurance cover?

What does boat insurance cover?

Buying insurance for boats and yachts and learning the basics may help you handle the unpredictable.

Preventing backovers and rearview safety

Preventing backovers and rearview safety

Backover deaths usually happen near the home and tragically, involve children. What every driver needs to know to help prevent backover deaths.